È stato attivato un servizio esterno che consente la stampa su richiesta (print on demand) di singole copie dei libri.

A tal fine è necessario rivolgersi per le informazioni relative alla Segreteria della RomaTrE-Press (epress@roma3education.it).

{{BCD.lang.loadingPleaseWait}}...

{{BCD.lang.oneFieldAtLeast}}...

Reset

Cerca per:

Ultime pubblicazioni

Print on Demand

Rapporti fra norme primarie e secondarie

Rapporti fra norme primarie e secondarie è la prima monografia che Giuliano Amato, allora assistente di diritto costituzionale nell’Università di Pisa, pubblicò, appena ventiquattrenne, nel 1962.

Albert Camus. Alla ricerca di un nuovo umanesimo

La ricerca di un rinnovato umanesimo è un’urgenza imprescindibile nel mondo attuale

Costruire la rete dei cpia del Lazio. Quaderni della ricerca. Centro di ricerca sperimentazione e sviluppo del Lazio

Il volume fa riferimento ai temi emergenti dalla costituzione del sistema di istruzione degli adulti in Italia (Cpia)

Studi sull’accordo di non chiedere

Il libro affronta il tema, antico e contemporaneo, del patto di non chiedere.

Alfredo Pirri. Architetto

Il 2 ottobre 2023 il Dipartimento di Architettura dell’Università degli studi Roma Tre conferisce ad Alfredo Pirri la Laurea Honoris Causa in Progettazione Architettonica. Attraverso i contributi di coloro che ...

Orizzonti di accessibilità. Azioni e processi per percorsi inclusivi. Accessibilità e cultura

La strada condotta negli anni sul tema dell’accessibilità fino alle sollecitazioni del Design for all, le convenzioni internazionali (UN, UNESCO, ONU) e il quadro normativo più volte affinato nel ...

Accessibilità e inclusività nei centri storici minori. Esperienze e riflessioni per una migliore fruizione del patrimonio materiale e immateriale

I centri storici minori rappresentano una costellazione di luoghi che esprime un patrimonio urbano, storico e culturale di dimensioni straordinarie.

Porta Appia e le Mura Aureliane. Fasi costruttive e risarcimenti delle strutture murarie

L’idea di questo lavoro è nata dalla osservazione ravvicinata delle superfici esterne, e per tutta la loro altezza, di Porta Appia in occasione dei lavori di restauro eseguiti per ...

Victor von Weizsäcker. Educare e soccorrere. Ippocrate e Paracelso

Nel suo saggio del 1926, qui tradotto, Victor von Weizsäcker mostra una conoscenza approfondita della medicina greca e delle sue correnti interne

Sincronías Barrocas (siglos XVI-XVIII). Agentes textos y objetos entre Iberoamérica, Asia y Europa

Sincronías barrocas offre prospettive decentrate sugli incontri tra Asia, Iberoamerica ed Europa, dal XVI al XVIII secolo.

20/Venti. Nuovi studi sulla cultura russa e sovietica degli anni Venti del XX secolo

Il volume raccoglie saggi dedicati alla cultura russa e sovietica degli anni Venti del XX nati nella cornice di 20/Venti

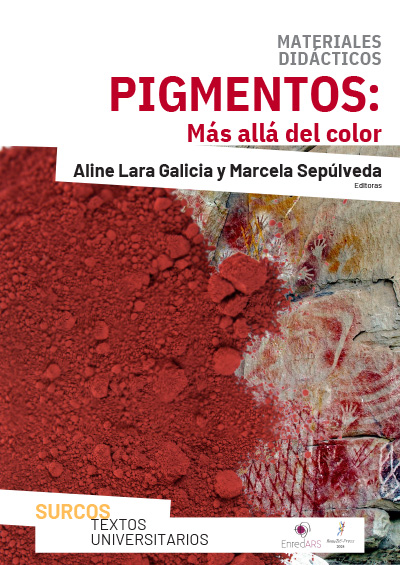

Pigmentos: más allá del color

Il tema di questa pubblicazione scientifica educativa e divulgativa intende raggiungere il general pubblico e le persone legate al mondo della comunicazione scientifica, con alcuni esempi dello studio dei ...